In my last post, I commented on the regional investment market in advance of the Munich Expo in October. This time we turn to MAPIC, the big event on the retail commercial real estate (CRE) calendar that’s hosted in Cannes, France.

Now the idea of “Retail in Cannes” struck me as an opportune opening gambit for this next piece, given the ongoing and rapid evolution of how we consume our goods. Goods don’t just come in one size, in cans or boxes stacked on shelves anymore. They appear nicely packaged on laptops, smartphones, tablets and other tech devices readily available for comparison and consumption. We can even view and “virtually test” what products could look like in stores and on the go.

But with this ever growing array of goods at our fingertips, to what extent has this impacted the traditional brick-and-mortar retail formats across the CEE region?

There are quite a few things to consider here. So, we’ll split this subject into two separate blog posts (I know all about modern day attention spans):

- How and why retailers are altering their operating model

- The impact this is having on brick-and-mortar retail real estate

Firstly, how and why are retailers altering their operating model?

Headline e-commerce growth trends

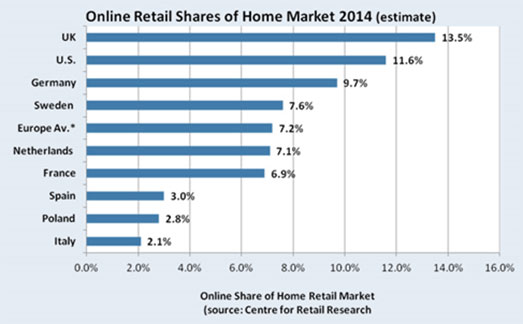

The CEE region is definitely behind the curve when it comes to the adoption of e-commerce, but it is evolving rapidly. In Europe, the U.K. has followed some of the patterns seen in the US, with Germany and France not too far behind. Core CEE markets such as the Czech Republic and Poland are copying some of the U.K., German and French trends, and it remains to be seen how other parts of CEE will follow. Russian is taking its own rapid growth path.

Online retail sales as a percentage of all sales are currently only up to around 3% to 4% in Poland, Russia and the Czech and Slovak Republics as of 2014, compared to around 10% in Germany and up to 14% in the U.K. So, we are only in the early phases of this retail evolution, but we can see the impact it is having on retailer operating models.

Infrastructure is improving

Firstly and critically, the supporting infrastructure allowing retailers to operate multichannel or omnichannel retailing is being put in place. Our analysis shows that, since 2011, e-commerce occupiers of logistics space in the CEE region have increased fourfold from 1.9% in 2011 to 9.1% in 2013.

Reliable delivery of purchases to consumers is also crucial in expanding the e-commerce customer base. Statistics for the Polish market by Dotcom River shows that 91% of e-commerce deliveries are done by just three courier companies: UPS, DPD and DHL. This suggests room for competition as these courier companies are certainly not the cheapest in the market. However, in a poll of customers, 86% were satisfied with the delivery service suggesting that e-commerce retailers place a premium on reliability and the level of service.

We know that some retailers in the U.S. witnessed declining profitability resulting from the cost of running supporting operations such as shipping and logistics, as much as the cost of investing in the technological platforms to support e-tailing. Amazon went online in 1995, posting its first profit in Q4 2001. It had to wait until 2003 to post its first yearly profit but continued to expand considerably across Europe and more recently into CEE. Amazon has taken on around 300,000 square meters in Poland alone in 2014.

Expanding the operating model

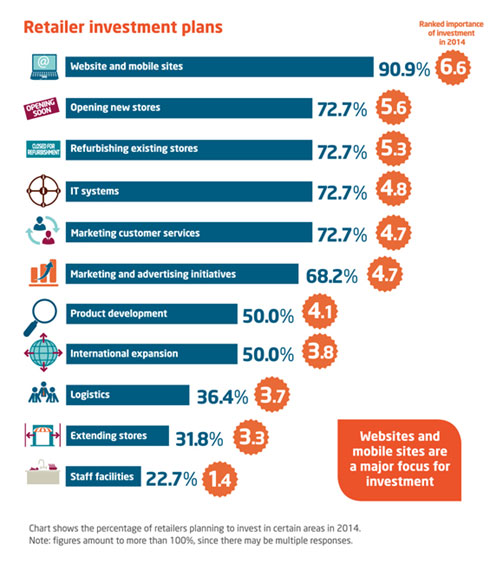

In the Retail Growth Strategies Survey 2014, commissioned by the law firm TLT in the U.K., 40.9% of retailers said they are planning to invest more this year than they did in 2013, with more than 90% of retailers identifying websites and mobile sites as key areas for investment over the year.

A recent study by Boston Retail Partners, a retail consulting firm, found that 93% of respondents are working toward unifying their operations so that they can serve customers in a consistent way, whether they shop by way of bricks-and-mortar or via e-commerce. The report says, “Online is no longer a strategy to expand the sales channel; it’s now part of a broad cohesive experience where mobile, online and in-store all support and reinforce the brand promise through seamless and flawless execution.”

The research showed that only 22% of retailers had merged their channel teams into a single organization, but more than 80% of respondents were expanding their online capabilities. There is clearly a long way to go for the majority of retailers to streamline customer service experiences and to improve operating efficiencies, but they are getting there. We can now see evidence of this in stores:

- RFID: Radio-frequency identification (RFID) provides a way to identify and monitor stock without manual data entry so garments can be tracked all the way from the factory, on their shipping routes, to the store and to the customer. Inditex has partially rolled out RFID technology to its Eastern European Zara stores. The initiative announced in July 2014 is expected to be progressively rolled-out to their other brands by 2016. In this case, RFID is being used to code garments to improve the distribution platform, track the location of garments in-store and provide an immediate alert if stock replenishment is required, thereby enhancing customer service.

- Another technology is augmented reality or AR. In retailing, the concept is still in its infancy, but many retailers are implementing this into physical stores to enhance the shopping experience. Lacoste has rolled out 3D-technology that combines product scanning and AR technology, allowing consumers to place their foot on an in-store floor graphic. Customers can then scan it to their smartphone to see the trainers (sneakers!) on their feet, request more information, share the image on social media and/or buy them through the store’s app. IKEA released a catalog in Europe earlier this year that allowed customers to preview selected furniture in 3-D and, for the first time, use their smartphones to see digitally how the item would look in your home. Topshop tested a similar application in Moscow, offering a virtual fitting room while a Ray-Ban store in St. Petersburg has a virtual mirror where you can try on sunglasses.

- Mobile technology is certainly revolutionizing the retail experience. Marketing efforts are closely related to technology, digital engagement and understanding how to collect and use big data analytics. In 2013, Tesco introduced a mobile version of its e-store for smartphones and click-and-collect points. The mobile e-store enables customers to save shopping lists and use a barcode scanner. Mobile marketing platforms such as Motorola‘s Hybrid Bluetooth beacon and Wi-Fi solution (currently in pilot phase) enable retailers to identify where participating shoppers with smartphones are located, provide them with targeted promotional data and connect to store personnel. Apple already has a similar concept rolled out in most of their stores, known as iBeacon.

- Retailers are also placing greater emphasis on consumers’ awareness of social media as a developing “sales” channel. The number of sales channels available to the consumer means that marketing needs to be integrated to support the consistent delivery of services.

In summary, there is much change going on behind the scenes in terms of how retailers and retail property owners are adopting a more cohesive, omnichannel operating model. Aside from the growth in demand for more modern logistics space, the most tangible aspects of this shift in strategy are manifested in the likes of RFID and AR within the retail space. The use of this new technology is still in its infancy. In my next post, we’ll look at how these operational changes and new technology have impacted the format of existing retail as we know it.

Damian Harrington is Director and Head of Research for Colliers International in EMEA. He has lived and worked across the region, has a focus on investment and a love of “all things shed,” even the garden variety.

Damian Harrington

Damian Harrington

Anjee Solanki

Anjee Solanki

Lex Perry

Lex Perry

Colliers Insights Team

Colliers Insights Team